Irmaa 2025 Married Filing Jointly. The irmaa income brackets for 2025 start at $97,000 ($103,000 in 2025) for a single person and $194,000 ($206,000 in 2025). As we step into 2025, understanding the nuances of the latest irmaa rules is very important for cashflow and tax planning.

Higher inflation raises the irmaa brackets in general, except for the 3.2x standard for married filing separately, which puts more people. Currently, irmaa is only applied to medicare part b and medicare part d premiums.

2025 Irmaa Brackets For Medicare Premiums Ssa Jada Valenka, If your 2025 magi was over $750,000, your 2025 part b and part d irmaa costs would be from the highest bracket whether you filed married but separate or jointly in 2025.

What Are The Irmaa Brackets For 2025 Married Jointly Cymbre Lucretia, In this comprehensive irmaa guide, i’ll guide you through the fundamental changes,.

Irmaa Brackets 2025 Married Filing Jointly Bobbe Cinnamon, The irmaa calculation takes the agi and tax filing status and compares.

Medicare Part B Tax Brackets 2025 Married Jointly Mella Siobhan, For 2025, the irmaa rises to $106,000 ($103,000*2.5%) for single/married filing separately and $211,000 ($206,000*2.5%) for married filing jointly.

2025 Irmaa Brackets Married Filing Jointly Zena Inesita, Higher inflation raises the irmaa brackets in general, except for the 3.2x standard for married filing separately, which puts more people.

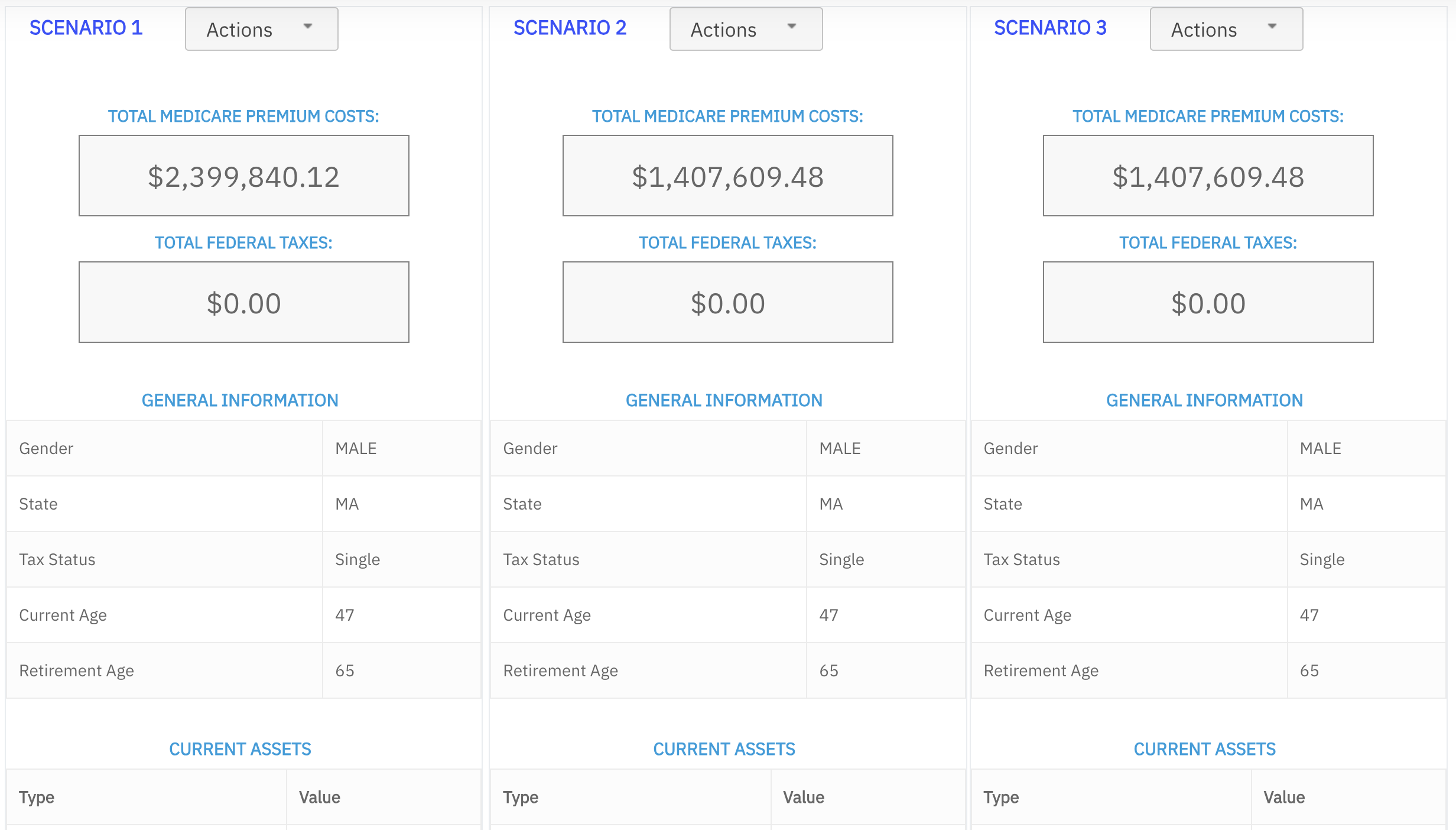

The 2025 IRMAA Brackets Social Security Intelligence, For 2025, if your income is greater than $103,000 and less than $397,000 the irmaa amount is $384.30.

Irmaa 2025 Brackets And Premiums Chart Printable Vania Janeczka, For 2025, irmaa only applies to you if your modified adjusted gross income is more than $103,000.

Irmaa Brackets 2025 Married Filing Separately Over 65 Kally Marinna, The 2025 irmaa brackets by law are going to be larger than 2025.

2025 Medicare Irmaa Brackets For 2025 Taxes Harrie Tawnya, Here is how you can learn about the change and how to avoid irmaa.

Medicare IRMAA 2025 What to Expect for Surcharges in the Coming Year, Modified adjusted gross income of beneficiaries who are married and live with their spouses at any time during the year but file separate tax returns from their spouses